Investing

An Investing Guide For Beginners

Young readers often ask for investing tips and wonder how to get started. My typical response is that once you have a good handle on your finances – no credit card debt, student loans fully paid (or close to it), some cash saved up for emergencies, short-term goals are funded (or on the way) –…

Read MoreVanguard vs. Horizons: Your One-Ticket Investment Solution

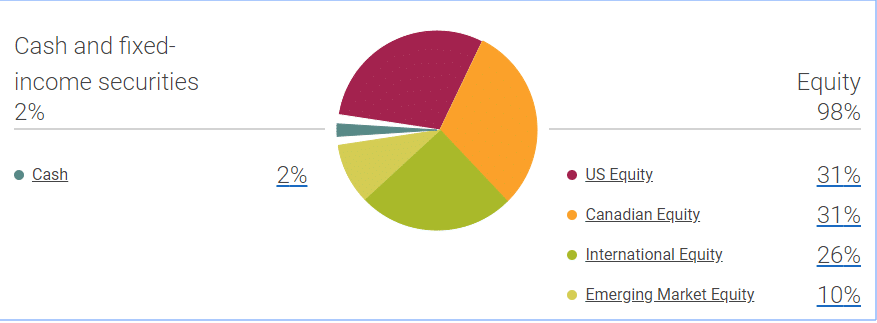

For most Canadians, mutual funds are still the mainstay of their investment portfolios. However, many investors are fed up with high fees that are being charged on mutual funds that rarely match, let alone outperform, the market. Investing in lower cost exchange-traded funds, or ETFs, seems like a good alternative. The knock on ETFs is…

Read MoreMaking It Easy For Canadians To Start Investing

This post is sponsored by RBC InvestEase Inc. All views and opinions expressed represent my own and are based on my own research of the subject matter. Young investors want a simple solution to manage their investments at a low cost and with minimal hassle. They want automated advice and professional guidance – but on their own…

Read MoreThe Crash That Never Came

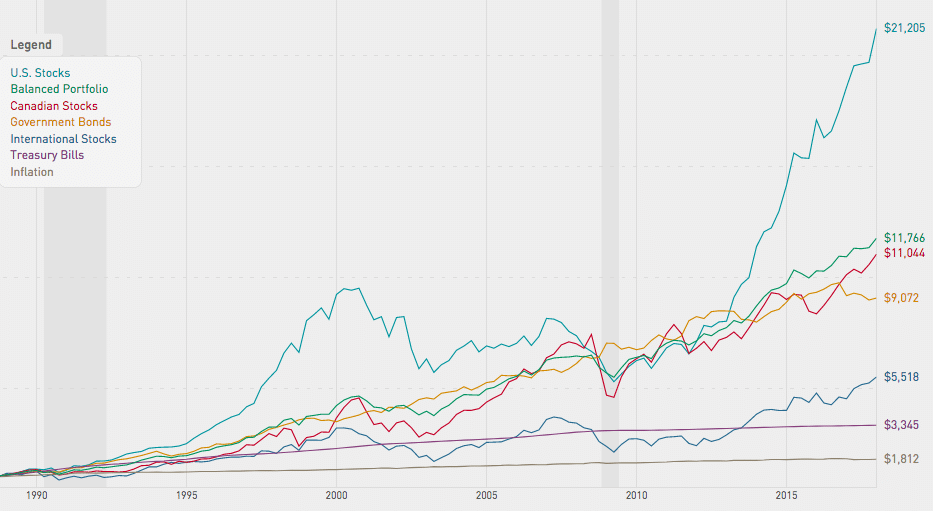

It’s been nearly 10 years since the global financial crisis bottomed out. Since then stocks have basically been on an uninterrupted tear, with the TSX doubling in value, and the S&P 500 nearly quadrupling in value. In that time, investors have survived the European debt crisis, Greece’s debt crisis, a Russian financial crisis, the Brexit…

Read MoreOne Stock For 25 Years

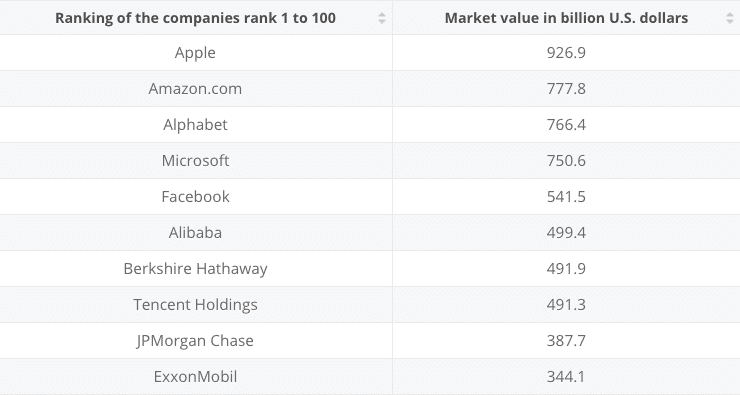

Let’s say you had to pick one stock to hold for the next 25 years – which one would it be? Would you select one of the most valuable companies in the world today, such as Apple or Amazon, with the idea that they’ll still be on top a quarter-century from now? Maybe you’d take…

Read MoreVanguard Enters Canadian Mutual Fund Market With Four Actively Managed Funds

Vanguard is eying the $1.5 trillion Canadian mutual fund market and dipping its toes in with the launch of four new actively managed products. The investment giant is best known north of the border for its low cost exchange-traded funds (ETFs), but is no stranger to mutual funds, where Vanguard cut its teeth decades ago…

Read MoreDisappointing Day For Canadian Investors: No Ban On Embedded Commissions

In what should have been a historic day for Canadian investors, the Canadian Securities Administrators (CSA) instead disappointed with watered down reforms that skirt around the edges of true investor reform. What investor advocates wanted was a ban on embedded commissions charged from mutual fund sales, and for the industry to adopt a best interest…

Read MoreSh*t My Advisor Says

Some investors eventually leave their commission-based advisors and opt to set-up a simple portfolio of index funds or ETFs on their own. There are plenty of compelling reasons to do so; the reduction in fees alone can save investors thousands of dollars a year, and academic research shows that the lower your costs, the greater your share of…

Read MoreStriking A Balance Between Risk And Reward

I read this story about a couple planning their wedding – let’s call them Carl and Vanessa. Vanessa wanted the ceremony to be held in a park next to a lake, but it would be several kilometres from town. The problem, practical Carl said, was there were no buildings in the vicinity should the weather…

Read MoreI Did The Math On Your Investment Fees And The Results Weren’t Pretty

A few weeks ago I invited readers to share their portfolio details with me so I could help ‘do the math’ on their investment fees. Many of you did, and the results weren’t pretty. From accounts loaded with deferred sales charges (DSCs), management expense ratios (MERs) in the high 2 percent range, and funds overlapping…

Read More