Weekend Reading: Teaching Financial Literacy Edition

“We really ought to teach financial literacy in school.” That’s the default answer from financial experts when we hear another story about Canadians who are up to their eyeballs in debt. It’s not that I disagree – I’d love to see a broad curriculum of age-appropriate financial topics all throughout school. The problem lies in the…

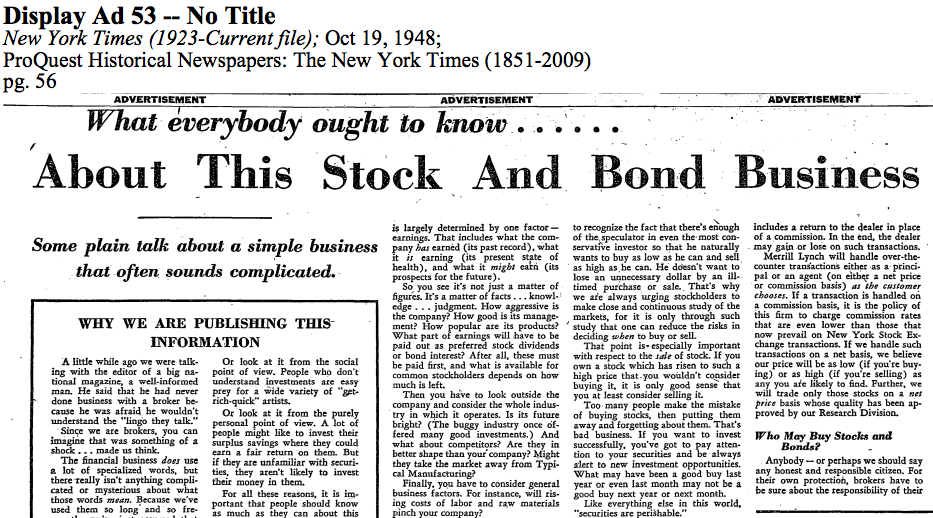

Read MoreWhat Everybody Ought To Know About This Stock And Bond Business

Back in 1946, a man named Louis Engel was hired to run the advertising and promotions at Merrill Lynch. Engel’s unorthodox approach to advertising resulted in thousands of leads for Merrill Lynch brokers nation-wide. How did he turn the investment industry on its head? By taking the investment broker lingo out of its advertisements, simplifying the message,…

Read MoreWhen Is A Pension Buyback Worth It?

Many workers have missed years of service in their employment history. Years away from work to raise children, recover from an illness or injury, go back to school, or other absence can reduce future pension payments. If you are enrolled in a defined benefit pension plan you may be allowed to buyback those periods during…

Read MoreThe Biggest Lie in Investing: Protection on the Downside

Imagine for a moment that you’re a small business owner in your late forties. Over the years you’ve worked hard to build up your company; a strip mall that consists of a car wash, gas station, and liquor store. With most of your assets tied up in the small business you don’t have much else in terms of…

Read MoreWeekend Reading: Home Capital Meltdown Edition

Home Capital Group is teetering on bankruptcy after a wild week that saw its shares plunge 65 percent Wednesday. The former dividend darling and sub-prime lender sought out $2 billion in funding just to stay afloat after a run on its bank deposits could leave the company with just over $500 million in cash –…

Read MoreThe Long and Short of it: A Look at Long-Term vs. Short-Term Mortgages

Interest rates have nowhere to go but up. No doubt you’ve heard this line if you’ve bought a home or had to renew your mortgage at some point in the past decade, followed by an eager banker or mortgage broker urging you to “lock-in” now. Most homeowners in Canada prefer fixed rate terms for predictability and…

Read MoreA Financial Success Plan For New Graduates

All across the country, university and college students are finally donning their robes and mortarboards and stepping across the stage to receive their diplomas. It’s an exciting time. For many new graduates, it may be the first real taste of independence – finding a job, a place to live, paying off those student loans. It…

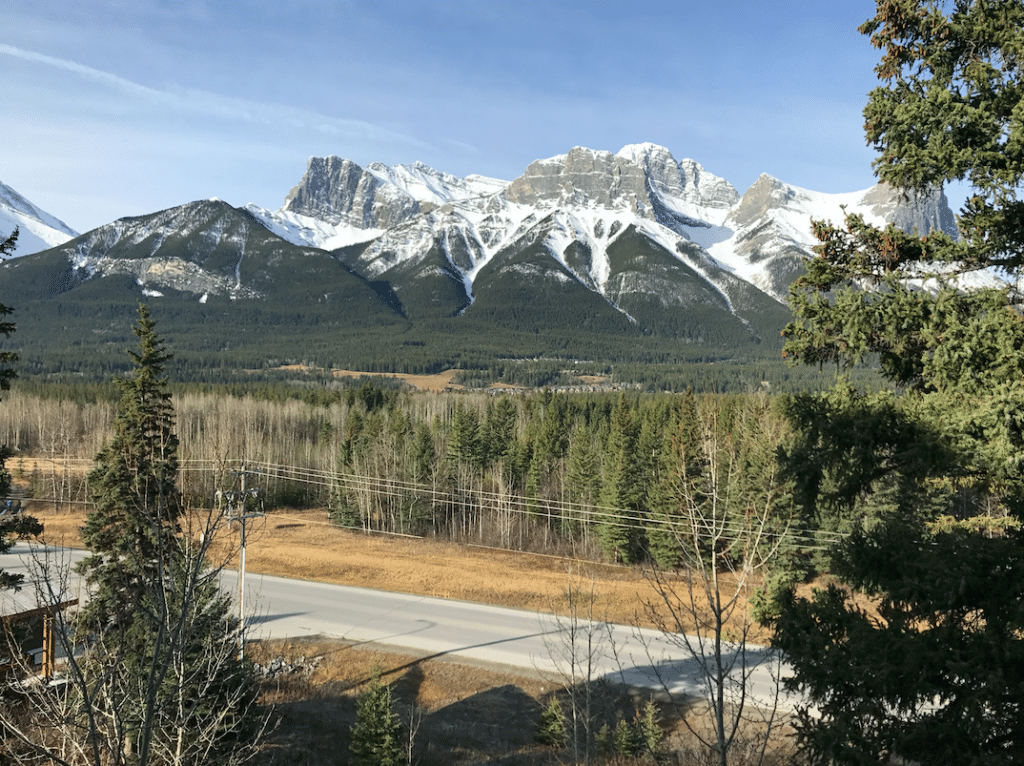

Read MoreWeekend Reading: Rocky Mountain Edition

We spent the last few days in Canmore / Banff enjoying the breathtaking scenery in Kananaskis Country and the Rocky Mountains. The kids loved Afternoon Tea at The Fairmont Banff Springs and the highlight of our trip was taking the Banff Gondola up Sulphur Mountain to check out the 360-degree observation deck, stroll along the ridgetop…

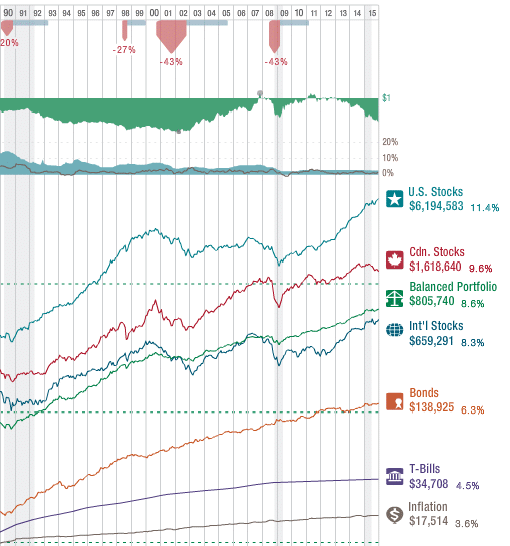

Read MoreFrom The Boomer & Echo Mailbag: The Role Of Fixed Income In A Portfolio

Q. I understand that to have a properly balanced account around half of our investments should be in fixed income products. However, most bonds have a ridiculously low return. GICs are an option, as are high interest savings accounts. Are there better solutions? I know it’s difficult to hold on to low paying fixed income…

Read MoreTry A 30-Day No Spending Challenge

The rule is simple. Cut out all non-essential spending for one month. No dining out. No trips to the craft or home improvement store. No new clothes or gadgets. No movie theatre, local pub, or sports event. Absolutely no credit card purchases. You still need to pay your normal bills – rent or mortgage, utilities,…

Read More