Posts by Boomer

A Financial Success Plan For New Graduates

All across the country, university and college students are finally donning their robes and mortarboards and stepping across the stage to receive their diplomas. It’s an exciting time. For many new graduates, it may be the first real taste of independence – finding a job, a place to live, paying off those student loans. It…

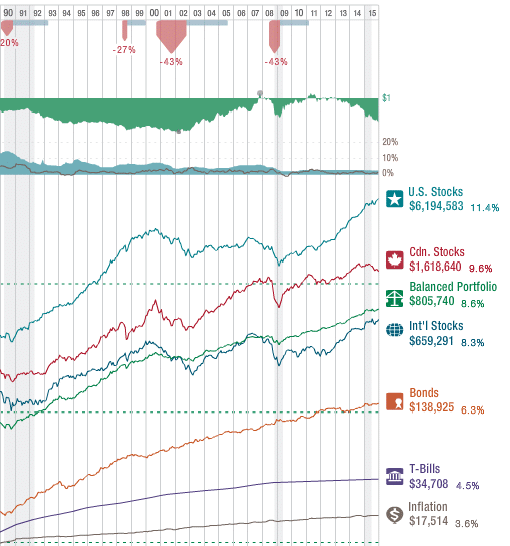

Read MoreFrom The Boomer & Echo Mailbag: The Role Of Fixed Income In A Portfolio

Q. I understand that to have a properly balanced account around half of our investments should be in fixed income products. However, most bonds have a ridiculously low return. GICs are an option, as are high interest savings accounts. Are there better solutions? I know it’s difficult to hold on to low paying fixed income…

Read MoreTry A 30-Day No Spending Challenge

The rule is simple. Cut out all non-essential spending for one month. No dining out. No trips to the craft or home improvement store. No new clothes or gadgets. No movie theatre, local pub, or sports event. Absolutely no credit card purchases. You still need to pay your normal bills – rent or mortgage, utilities,…

Read MoreIt’s Time To Overhaul The Finance Industry

Canadians have been abuzz with the news of shady bank practices and the “what’s in a name?” controversy over advisors vs advisers instigated by the CBC. But the real problem is how the entire financial industry is regulated. Provincial regulators need to overhaul the requirements for the financial industry to better protect investors. Sure, they’ve…

Read MoreIt’s Time To Declutter: Free Your Home Of Unnecessary Junk

When my mother-in-law passed away I had to sift through all of her possessions and dispose of them so we could sell her house. A couple of years later, I went through the same process when my own parents moved into a retirement home. Then I was at it again when my husband and I…

Read MoreBuilding Your Wealth: Employee Stock Purchase Plans

I regret to say I didn’t participate in my employer’s pension plan. However, I did join the employee savings plan – now called employee stock purchase plans. The resulting investment eventually became the backbone of my retirement plan. Many employers have stock plans that allow their employees to purchase shares in the company at a…

Read MoreGrowing Your Wealth: Managing Investment Fees

Effective January 1, 2017, new rules compel investment firms and advisors to clearly outline the costs of any funds held by their clients. Previously, many investment fees were hidden within incomprehensible prospectuses and financial reports that most investors rarely read. How do the various fees you pay on your investments – whether you do it…

Read MoreDon’t Allow Debt To Derail Your Retirement Plans

Many people approaching retirement may be delaying those plans due to their debt loads. Boomers are not known for thrifty living. They have earned the title of the “most indebted generation.” According to a Statistics Canada 2012 Survey of Financial Security, 70% of people aged 55 to 64 are carrying some debt. One-third still have…

Read MoreBanks Behaving Badly

The media has been all abuzz lately about the Big-5 Banks and the shady practices they are using to dupe unsuspecting customers. I was approached twice by CBC for an interview which I declined both times. The reason? First of all, the mere thought of appearing on live national TV gives me a full-blown panic…

Read MoreGood Riddance To Deferred Sales Charges

As of January 1, 2017, Investors Group has eliminated deferred sales charges (DSC) on all new lump sum investments to their funds. The good news is that dropping the DSC is part of a new trend by investment brokers to replace this archaic charge for withdrawing your own money with a more up front fee-for-advice…

Read More