Archive for January 2023

So You’ve Made Your RRSP Contribution: Now What?

It’s a classic mistake I’ve seen time and time again. You scramble to make your RRSP contribution before the deadline and then give yourself a giant pat on the back. But wait a minute. You’re not done yet. Not if your RRSP contribution is just sitting idly in cash. You need to put that RRSP…

Read MoreIntroducing A New DIY Investing Course

It’s finally here. A do-it-yourself investing course for regular people who want to save on fees and complexity by using a low cost, all-in-one, automatically rebalancing ETF. I want to help investors move on from paying 2% MER for a balanced mutual fund at their bank. I want to help new investors set up a…

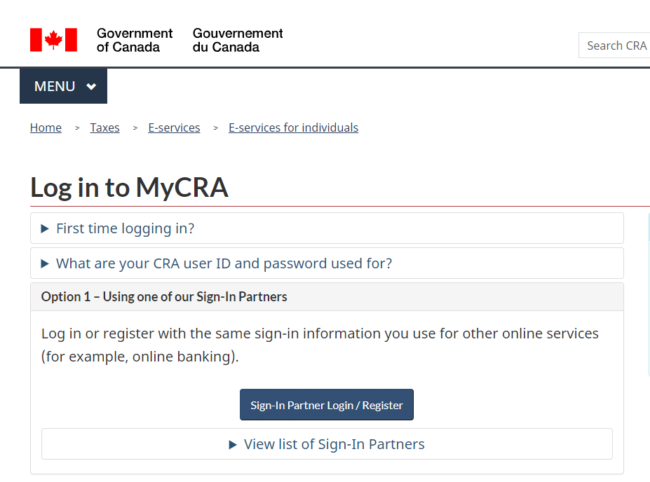

Read MoreCRA My Account: How To Check Your Tax Information Online

If you’ve ever tried to contact the CRA by phone and received a busy signal, or sat on hold interminably waiting for a service rep, as I did recently trying to change my address, you’ll be happy to know about CRA My Account for Individuals. Online services offered by the banks and other financial institutions…

Read MoreWeekend Reading: Finances in Flux Edition

Regular readers know that I update and post my net worth twice a year, including a year-end summary. They should also know that I didn’t post an update at the end of 2022. It’s not because I’m embarrassed that my portfolio suffered losses for the first time in recent memory. That’s a feature of financial…

Read MoreThe Beginner’s Guide To RRSPs

More than sixty years after the federal government introduced the Registered Retirement Savings Plan as a vehicle to save for the future, RRSPs still remain one of the cornerstones of retirement planning for Canadians. In fact, as employer pension plans become increasingly rare, the ability to save inside an RRSP over the course of a…

Read More3 Investing Headlines To Ignore This Year

Last year was brutal for both stocks and bonds. In the middle of the year, during what turned out to be the market bottom (and inflation peak) I suggested you stop checking your portfolio. This comes from the analogy that your portfolio is like a bar of soap; the more you touch it the smaller…

Read More